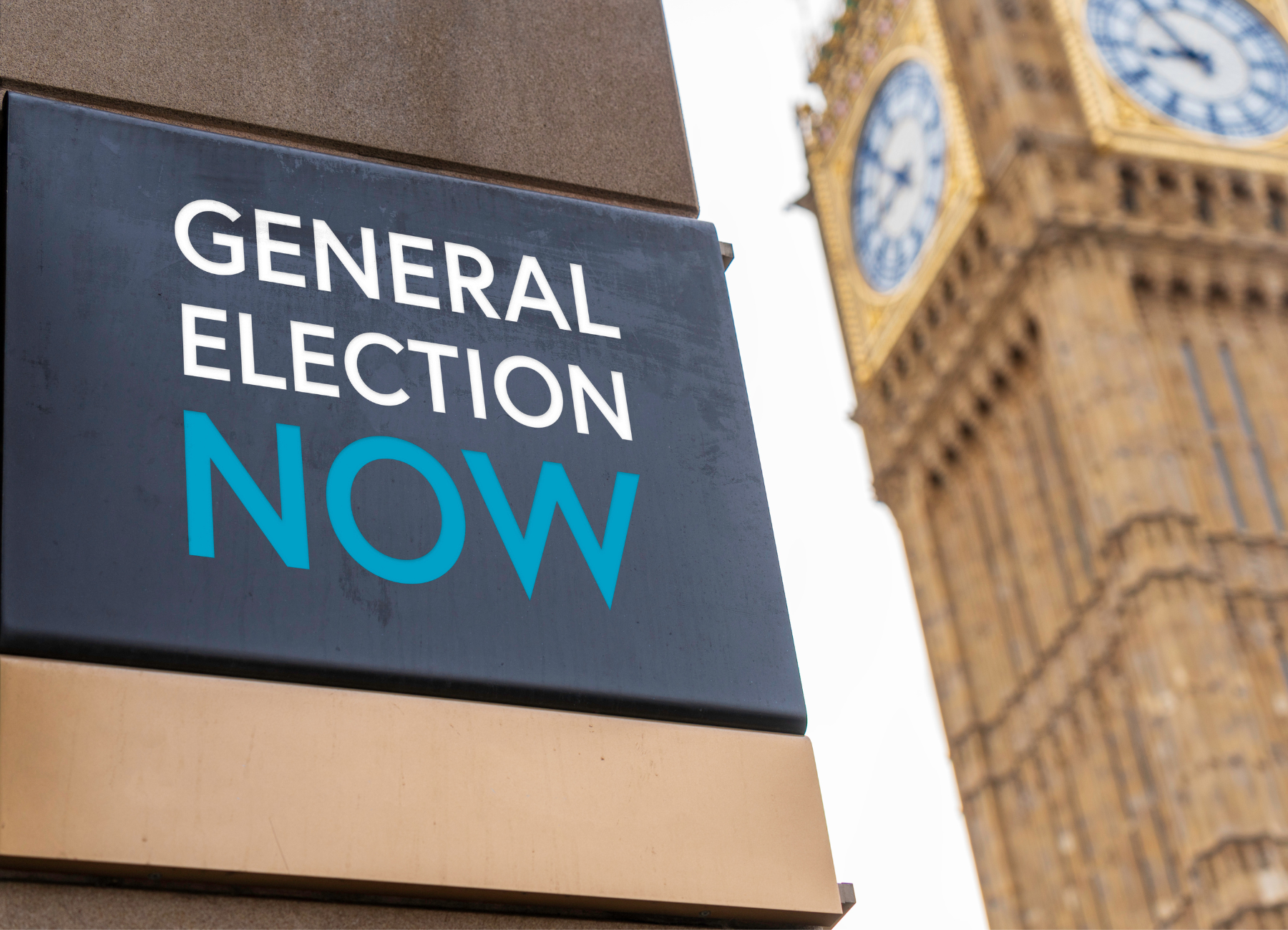

Economy takes center stage as General Election is confirmed for 4th July.

With the general election officially scheduled for 4th July, it is evident that tax policies and the economy will be major focal points in the campaign.

With the election date set, it is clear that the Chancellor has in fact revealed all his plans in the Spring Budget. Despite earlier rumours, there will not be a pre-vote fiscal statement. Also, it’s no coincidence that the Prime Minister announced the general election on the same day inflation dropped to 2.3%. Encouraged by this news, the government anticipates inflation will decrease further to around 2% by early summer, potentially by the election date.

The economy is rapidly becoming a battleground for the Conservatives and Labour, with both parties exchanging criticisms repeatedly in recent months. With a confirmed election date, we can naturally expect much more of this.

Sunak promised to grow the economy and halve inflation, a goal he has nearly achieved. However, the cost of living crisis has significantly impacted the working class across all political affiliations, from the “Essex man” to the typical “progressive activist”—voters whom Labour aims to attract—while national debt remains at levels not seen since the 1960s.

The Prime Minister has been waiting for inflation to fall to demonstrate he can be trusted with the nation’s economic security and that his plan to improve conditions for those hardest hit has worked. Despite this, recent polls suggest Labour is viewed more favourably than the Conservatives when it comes to representing working families and managing the economy. According to the More in Common thinktank, 65% of voters believe the Tories are primarily for the wealthy.

Pre-election Finance Bill rumours

There is also speculation mounting about a possible finance bill that could be introduced in the final days of the current Parliament, aimed at implementing another tax cut before the dissolution.

This move could strategically place the Labour Party in a difficult position, forcing them to either support or oppose the tax cut just before the election.

For accountancy firms like ourselves, we will need to quickly adapt to the new regulations, ensuring that our clients—both individual taxpayers and businesses—are fully compliant and able to take advantage of any new tax reliefs or incentives. If you have any questions in the coming months, either before or after the general election, please don’t hesitate to get in touch.